Charles Schwab International Review 2025

The US broker Charles Schwab offers a brokerage option for Swiss customers with their Charles Schwab International Account. In this article, we will look at the key features and fees of Charles Schwab and compare them with Interactive Brokers.

About Charles Schwab

| Account maintenance fee | free |

| Inactivity fee | free |

| Currency exchange fee | 1% |

| Trading US stocks and ETFs | free |

| Trading non-US stocks | $50 per trade |

| Initial minimum deposit | $25,000 |

| Minimum account balance | $1,000 |

| Debit card | Free Visa debit card with worldwide fee reimbursement |

| Deposit currencies | CHF possible (automatically converted to USD) |

Why a US Broker?

Many Swiss investors want to invest in ETFs domiciled in the USA. Unfortunately, this is not possible with European brokers like Degiro or Swissquote. Instead of the popular Vanguard VTI ETF, one must limit themselves to European ETFs like the Ireland-domiciled Vanguard VWRL, which has higher fees compared to its American counterpart. Additionally, for Swiss investors, US ETFs are more advantageous from a tax perspective, as they can reclaim 15% US withholding tax through bilateral tax agreements.

Charles Schwab vs Interactive Brokers

So we know that to access the best ETFs, we need a US broker. There are two major players in Switzerland for this: Charles Schwab and Interactive Brokers. Let’s look at both based on a few criteria:

- Fees: Schwab charges no trading fees for US trades.

- Minimum deposit: Interactive Brokers has no minimum deposit requirement, whereas Schwab requires $25,000 after account opening. However, in our experience, this rule is not strictly enforced.

- Currency exchange: Deposits at Schwab are automatically converted to USD. A fee of 1% is charged for this. At Interactive Brokers, you can deposit CHF and exchange it for USD at competitive rates.

- User-friendliness: Both have a functional user interface. While both are somewhat technical and not entirely easy to use, Interactive Brokers is considered by us to be slightly more modern and easier to navigate.

- Debit card: Schwab offers a Visa debit card that refunds any fees for cash withdrawals abroad. Interactive Brokers does not offer anything like this.

Overall, Interactive Brokers offers a better package, especially because of the ability to deposit Swiss francs directly. Otherwise, the two brokers are not significantly different. However, Schwab is an excellent option for those who want a second broker or need a debit card for travel.

Currency Exchange

The biggest disadvantage of Charles Schwab is that while you can deposit Swiss francs, they are automatically converted into USD at a fee of 1%. Moreover, we are not aware of any way to convert the money back into Swiss francs. Therefore, you would have to send USD directly back to your Swiss bank account and exchange it there at high fees.

If you do not earn your money directly in dollars, it is best to use a third party for currency exchange. Interactive Brokers offers by far the best conditions for this. You would transfer your Swiss francs to Interactive Brokers, exchange them there at ideal rates for USD, and then wire the funds to your Schwab account. However, it should be noted that Interactive Brokers does not look favorably on customers solely using their brokerage account for currency exchange.

Another option is Wise. This service is specifically designed for currency exchange. However, the fees here are higher than at Interactive Brokers.

| Interactive Brokers | 0,002 %, minimum $2 |

| Wise | 0,33 % and higher |

| Charles Schwab | 1 % |

Minimum Deposit

Charles Schwab has an initial minimum deposit of $25,000. This means that after opening the account, you must deposit at least $25,000 in cash or securities. However, you are not obligated to maintain this amount. Following the initial deposit, the practical experience is that this can be reduced to $1,000. You must therefore continuously maintain at least $1,000 in your account to avoid it being closed.

Is Schwab’s initial minimum deposit really enforced? In our experience, no. Usually, it is enough if one deposits only $1,000 initially. However, this does leave a risk that Schwab may close the account, as you are not formally complying with the rules.

Debit Card

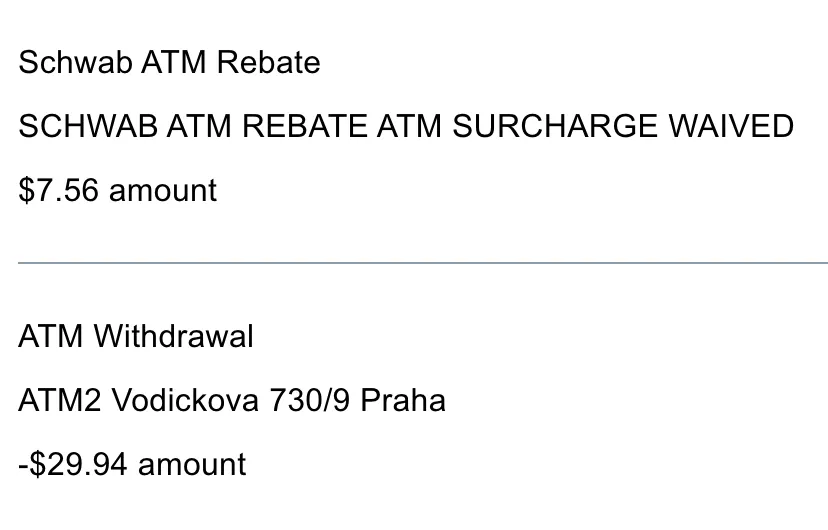

Charles Schwab has another advantage that no other bank or broker in Switzerland can offer: a debit card that allows you to withdraw cash worldwide for free. And “free withdrawal” does not only mean that Schwab does not charge fees. It also means that fees charged directly by the ATM are immediately refunded by Charles Schwab.

Here’s a practical example:

- Withdrawing 500 Czech Crowns (CZK) at an ATM in Prague

- The ATM charges a fee of 170 CZK

- The total cost of the transaction is around $30

- Schwab immediately refunds the 170 CZK fee

Simply put: There is no better way to withdraw cash than with the Schwab debit card, especially in countries where ATMs impose an additional fee. For frequent travelers, having a Schwab account can be beneficial solely because of the debit card, even without investing in securities.

Conclusion

Charles Schwab International has two decisive advantages: trading US securities without fees and a debit card that allows free cash withdrawals worldwide.

However, there are also two major disadvantages: the initial minimum deposit of $25,000 and the 1% currency exchange fee when depositing Swiss francs directly.

As discussed, the minimum deposit is not consistently enforced. And for currency exchange, you can use cheaper services like Wise or Interactive Brokers. Thus, you can first exchange Swiss francs at Interactive Brokers and then send them directly in USD to Schwab.

In our opinion, Interactive Brokers remains the best broker for Swiss investors. There is no minimum deposit, you can exchange Swiss francs affordably, and the interface is modern and user-friendly.

So who would benefit from a Schwab account? On one hand, it’s great for travelers wanting to withdraw cash worldwide. Frequent travelers can quickly save over $100 a year in ATM fees, particularly when traveling often outside of Europe, where ATMs frequently charge additional fees.

Charles Schwab is also an ideal second broker to Interactive Brokers. If someone does not want to invest all their money with IBKR, they can allocate part of it at Schwab and still benefit from US ETFs. However, it is recommended to do the currency exchange at IBKR.