Swiss Savings Accounts Comparison: Where to Find the Best Interest Rates in 2025

Interest rates for savings accounts in Switzerland are lower in 2025 than in 2024, but attractive savings accounts can still be found. In this article, we will show you the Swiss savings accounts that offer the best interest rates. Factors to consider include account maintenance fees and withdrawal limits. The interest rates shown in the article are based on October 2025 data and may change over time.

Why You Need a Savings Account

A savings account is not a great way to invest money. Even with a 2% annual interest rate, your money does not grow significantly. Stocks (especially ETFs) and bonds are much better for letting your money work for you. So why have a savings account? You need savings accounts to have a certain amount of money available at all times. Stocks can suddenly lose value, and bonds cannot be redeemed at any time. Therefore, it is important to have enough money in a savings account for emergencies. A so-called Emergency Fund. With this, you should be able to cover your expenses for a few months.

Other reasons for a savings account are if you suddenly receive a large amount of money — for example, from inheritance, gifts, or home sales. In that case, it is wise not to decide immediately where the money should go. Instead, it is good to wait for a while and place the money on a savings account in the meantime. Your money is available at any time in a savings account and is protected from market fluctuations. Additionally, all Swiss banks have deposit protection of up to CHF 100,000 per depositor through FINMA. All banks presented here have this protection. Thus, your money is also protected in the event of a bank failure.

Savings Accounts with the Highest Interest Rates

So, we want to place a certain amount of money in a savings account. While we cannot generate the same returns as with other investments, what we can do is slow down inflation through interest rates. This is where the savings accounts presented here come into play. They offer between 0.10% and 0.75% annual interest rates - without any account maintenance fees.

| Account | Interest Rate for CHF | Withdrawal Conditions |

|---|---|---|

| Bank WIR Savings Account Plus | 0.75% up to 250k | 20,000 per year, 6 months notice period beyond that |

| Cler Savings Account Plus | 0.70% | 50,000 per year, 6 months notice period beyond that |

| Cembra Savings Account Plus | 0.60% | 20,000 every 180 days, 6 months notice period beyond |

| Cembra Savings Account | 0.25% | 20,000 every 90 days, 3 months notice period beyond |

| Raiffeisen Member Savings Account | 0.25% (varies by branch) | 10,000 in 30 days, 90 days notice period beyond |

| wiLLBe Current Account | 0.10% | No limits |

Bank WIR Savings Account Plus

WIR Bank offers the highest interest rate - a full 0.75%. And this is up to CHF 250,000. No other bank offers such high interest rates.

Here are the facts:

- Free account maintenance

- E-banking and mobile banking

- Immediately withdraw 20,000 per calendar year

- 6-month notice period for amounts above this

So, the downside of this savings account is that “only” CHF 20,000 can be withdrawn per year without notice. This is not optimal if you need the account as an “emergency fund.” However, if you want to park a larger amount of money for a longer period and maximize interest, this account is a good choice.

Cler Savings Account Plus

The conditions at Bank Cler are similar to those at Bank WIR, but the high interest rate is time-limited.

Here’s an overview:

- Free account maintenance

- Base interest rate of 0.10%

- Additional +0.60% bonus interest for one year from account opening, on a maximum of CHF 250,000

- Withdrawal of 50,000 per calendar year, 6-month notice period beyond that

To receive the additional bonus interest rate, there are some requirements:

- For 1 year after account opening for the entire account balance

- Then only for newly deposited money under CHF 250,000

- Revoked if more than CHF 20,000 are withdrawn

Cembra Savings Account and Savings Account Plus

Cembra Bank, mainly known for its credit cards, offers two different savings accounts. They differ in their interest rates and withdrawal limits.

For both accounts, the following conditions apply:

- No account maintenance fee

- No maximum amount

- Regulated Swiss bank with deposit protection

Savings Account

The regular savings account offers an interest rate of 0.25%. CHF 20,000 can be withdrawn every 90 days. For higher amounts, a notice period of 3 months applies.

Savings Account Plus

The Savings Account Plus offers a higher interest rate of 0.60%. However, only CHF 20,000 can be withdrawn every 180 days, i.e., semi-annually. For higher amounts, a notice period of 6 months applies. So, you sacrifice flexibility for a higher interest rate.

Raiffeisen Member Savings Account

For those who want to invest their money with one of the largest Swiss banks, Raiffeisen is a good choice. To open the Member Savings Account, you need to own a share certificate of the bank. This costs CHF 500 but also brings various other advantages.

Here are the account conditions:

- Free account maintenance

- 0.25% interest rate, varies by branch

- Typically lower interest rate above CHF 100,000

- CHF 20,000 freely withdrawable per month

- 3-month notice period beyond that

wiLLBe Current Account

wiLLBe is a brand of the Liechtensteinische Landesbank (LLB). Everything is managed via an app. In addition to the savings account, there is also an investment product, which we will not go into here. Even though it is not a Swiss bank, LLB still provides deposit protection of CHF 100,000, guaranteed by the Liechtenstein government.

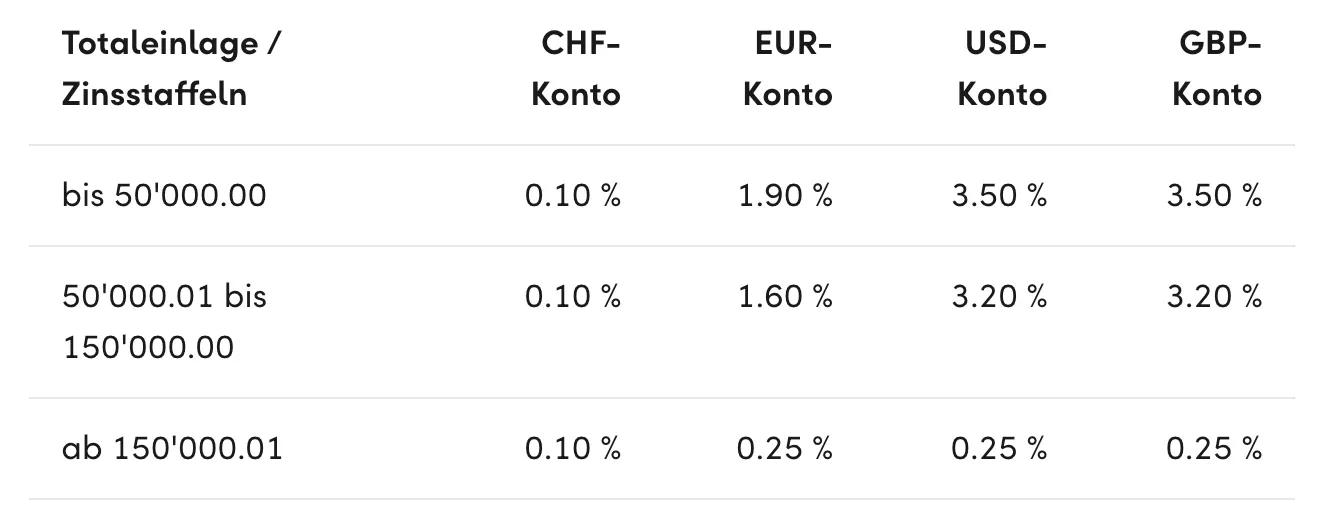

As seen here, wiLLBe is especially attractive for amounts under CHF 50,000. For those seeking even higher interest rates, there is the option to open a Euro or US dollar account. However, this exposes you to currency fluctuations - historically, the Swiss franc has always appreciated against the euro and dollar.

Additional conditions:

- No account maintenance fees

- Only via app, no web banking

- Interest credited every 3 months

- No withdrawal limits

What about Neobanks?

Neobanks also distribute some interest. However, these are slightly lower than the other offers we have looked at in this article.

Neon

Neon has not been paying interest since December 1, 2024.

YUH

YUH does not pay interest.

Cler ZAK

ZAK Savings from Cler offers 0.30% interest up to CHF 100,000.

Radicant

Radicant offers 0.10% interest without withdrawal restrictions.

The Best Savings Account

For most people, the Savings Account Plus from WIR Bank is the best choice. It offers the highest interest rate compared to other options at 0.75%. Moreover, the interest rate is guaranteed up to CHF 250,000. The downside is that only CHF 20,000 per year can be withdrawn without notice.

For those who need more flexibility and want to use the savings account as an “emergency fund,” the Cler Savings Account Plus is worth a closer look. With 0.70% interest (in the first year after account opening) and CHF 50,000 annual withdrawal limit, it offers a good compromise between return and availability.

For those who are already customers of Raiffeisen, like many Swiss people, the Member Savings Account should be examined more closely. With 0.25% interest, it is not the most lucrative offer, but the advantage is that you do not have to register with a new bank and everything is available in the same e-banking system.

For maximum flexibility without withdrawal limits, the wiLLBe Current Account is a good option, even though the interest rate of 0.10% is very modest. For those who want to invest in foreign currencies like the euro and dollar, wiLLBe offers higher interest rates. However, it should be noted that you are then exposed to currency fluctuations and historically, both foreign currencies have lost value compared to the Swiss franc.