Best Swiss Credit Cards Without Foreign Transaction Fees for 2025

Overview - The Best Credit Cards for Foreign Payments

| Card | Currency Exchange | Cash Withdrawal Abroad |

|---|---|---|

| Radicant | 0% without limit | CHF 2 per withdrawal |

| Neon | 0.35% (0% with Neon Plus) | 1.5% (1% with Neon Plus) |

| Revolut | Free up to CHF 1250/month | Free up to CHF 200/month |

| Wise | Around 0.5% fees | Free up to CHF 200/month |

| Migros Cumulus Visa | 0% (with 1-3% exchange rate markup) | 2 free withdrawals per year |

Almost everyone pays abroad from time to time nowadays, whether by card payment or cash from an ATM. Unfortunately, this often comes with high fees. Swiss banks like to charge several percent fees for the privilege of being able to pay abroad. Cash withdrawals are even worse. There, fees often start at CHF 10 per transaction.

You don’t even have to go abroad to make a foreign transaction. Popular online shops like Amazon.de charge in euros. And even if the transaction is in Swiss francs, it can happen that the company is based abroad and therefore foreign fees apply.

If you want to save money, you need to find out which products to use to minimize fees. Here I present four different credit cards with which you can travel cheaply abroad. Strictly speaking, three of them are not real credit cards. They are debit Visa or Mastercard cards. However, these are just as easily accepted worldwide.

Radicant - the cheapest payment method abroad

0% (no limit)

CHF 2 per withdrawal

Special Features

No account management fee

0% markup on interbank exchange rate, no limit

Only CHF 2 per cash withdrawal abroad

One-time card fee of CHF 15

Full Swiss bank account

Radicant is a relatively new neo-bank on the Swiss market, distinguished by its focus on sustainability and especially cheap foreign transactions. As a full Swiss bank account, Radicant offers all the basic banking functions needed in everyday life, as well as a dedicated Twint app.

The Radicant debit card is especially interesting for travelers and international online shoppers. It offers one of the best exchange rates on the market with 0% markup on the interbank exchange rate and no monthly limit. Radicant charges CHF 2 fees for cash withdrawals abroad. This is significantly cheaper than most Swiss banks, but not completely free like Revolut or Wise. The physical debit card can be ordered for a one-time fee of CHF 15.

Disadvantages of Radicant

Although Radicant impresses with currency exchange, there are some limitations. The CHF 2 fee per cash withdrawal is low compared to traditional banks but cannot compete with the free withdrawal allowances of other fintech banks. Also, the bank is still relatively new on the market.

Neon - the Swiss bank account without foreign fees

0.35%

1.5%

Special Features

No annual fee

One-time card fee CHF 20

Transparent fee structure

Full Swiss bank account

Neon Plus (CHF 20/year): 0% markup on reference rate

Neon Global (CHF 80/year): 0% markup and 0.5% ATM fee

Neon Metal (CHF 150/year): 0% markup and free ATM withdrawals

Neon is one of the most popular neo-banks on the Swiss market. It is a full Swiss bank account operated purely via an app. There are no branches. Everything happens digitally. In this article, we focus on Neon’s debit card.

The basic Neon account is free and offers the following conditions:

- No annual fee

- One-time card fee of CHF 20

- 0.35% markup on Mastercard reference rate for foreign payments

- 1.5% fee for cash withdrawals abroad

For price-conscious travelers, Neon offers three paid subscriptions:

Neon Plus (CHF 20 per year):

- No markups on the reference rate for foreign payments

- Reduced 1% fee for cash withdrawals abroad

- One-time card fee of CHF 20

Neon Global (CHF 80 per year):

- No markups on the reference rate for foreign payments

- Only 0.5% fee for cash withdrawals abroad

- No one-time card fee

Neon Metal (CHF 150 per year):

- No markups on the reference rate for foreign payments

- Free cash withdrawals abroad

- No one-time card fee

Disadvantages of Neon

The fee structure is transparent and without hidden limits. But: the days of free foreign transactions are over – for this privilege, you now have to pay at least 20 francs per year for Neon Plus. The transparent fee of a comparatively low 1.5% for cash withdrawals abroad is still very competitive, and 0.35% markup on the reference rate is bearable. However, there are some important limitations to note: The Neon card is technically a prepaid card and therefore not accepted everywhere as a debit card, for example at the post office or in some stores. Also, Neon does not offer its own Twint app or desktop e-banking. The mobile app can occasionally be somewhat unstable.

Revolut - the international solution

Free (limit CHF 1250/month)

Free (limit CHF 200/month)

Special Features

No annual fee

Free currency exchange up to CHF 1250/month

Free cash withdrawals up to CHF 200/month

Premium plan available (CHF 10.99/month) with unlimited currency exchange and CHF 400 cash withdrawal

Modern app with bill-split function

Accounts in over 70 currencies possible

Virtual cards can be generated

Revolut has gained a lot of popularity across Europe in recent years. Basically, it is comparable to Neon or Radicant: a bank account via app with a debit card. Special is that you can open accounts in various currencies.

Regarding fees, Revolut offers the following:

| Currency exchange | Free up to CHF 1250/month, then 1% fee |

| Weekend fee | 1% fee on currency exchange |

| Cash withdrawals | Free up to CHF 200/month, then 2% (min. CHF 1) |

| Exchange rate | Own rate, comparable to interbank rate during the week |

For CHF 10.99 per month, there is the Premium plan with unlimited currency exchange during the week and CHF 400 free cash withdrawals per month.

Advantages of Revolut include that you can hold money in over 70 currencies in your account. In certain currencies, you get your own IBAN to send and receive money. This is not the case for Swiss francs. Other benefits are:

- International Twint equivalent, easy sending of foreign currencies to friends

- Modern app with features like virtual cards you can easily generate yourself

- Bill-split function for traveling with friends

Disadvantages of Revolut

Revolut has some important limitations to consider. As a foreign financial institution, Revolut is not a full Swiss bank and is therefore not subject to Swiss deposit insurance. This is also reflected in missing functions important for Swiss customers: There is no own IBAN for Swiss francs, making direct salary transfers difficult. Also missing is integration with the popular Swiss payment system Twint and the ability to receive and pay eBill invoices.

Another important point regarding currency exchange: Revolut does not use the true interbank exchange rate, but rather their own rate, which is slightly worse than the interbank rate. While the markup is small, this means that the exchange costs are not truly 0%, even within the monthly free allowance.

Due to these limitations, a Revolut account is not suitable as a primary bank account for everyday Swiss use but rather as a supplement for international transactions and travel. You can still easily and fee-free send Swiss francs to Revolut via a normal bank transfer.

Wise - international money sending and receiving

Around 0.5% fees on currency exchange

Free (limit CHF 200/month)

Special Features

No annual fee

Transparent exchange rates close to interbank rate

Free cash withdrawals up to CHF 200/month

Cost-effective currency exchange (approx. 0.5% fees)

Accounts in multiple currencies possible

Ideal for international money transfers

Wise, formerly Transferwise, specializes in international money sending. Like Revolut, you can send, receive, and hold money in various currencies. We are interested in the debit card you can order for your account. It comes with the following features:

- Cost-effective currency exchange for around 0.5% fees

- CHF 200 free cash withdrawals per month, above that 1.75%

The fees for cash withdrawals look like this:

| Less than CHF 200 | More than CHF 200 | |

|---|---|---|

| 2 or fewer withdrawals | Free | 1.75% on any amount over CHF 200 |

| 3 or more withdrawals | CHF 0.50 per withdrawal | CHF 0.50 + 1.75% on any amount over CHF 200 |

Overall, the costs are very similar to Revolut. I prefer Revolut because the first CHF 1000 per month can be exchanged for free. Also, Revolut is better for traveling with friends due to features like instant money sending to contacts and cost-sharing functions. Wise, on the other hand, is the more mature platform for sending and receiving large amounts internationally.

Disadvantages of Wise

Wise’s fee structure is transparent and fair. But: unlike Revolut, you cannot benefit from a free allowance for foreign transactions. From the very first franc, the 0.5% exchange fee applies.

Migros Cumulus - when you need a real credit card

0% on foreign currency, but 1-3% above reference rate

2 free withdrawals per year

Special Features

No annual fee

Free supplementary card

No explicit foreign currency fee

Two free cash withdrawals per year abroad

Real credit card (not a debit card)

Cumulus points on every purchase

I consider it important to have a real credit card when traveling. Often, you have to deposit a security deposit for rental cars and hotel stays. If you do this with your debit card, the money is blocked directly on your bank account. Suppose you have to deposit CHF 1000 for a rental car; this money is immediately debited from your bank account. Sometimes it can take weeks before it is available again. But if you use a credit card for the deposit, your credit limit is used, and you never have to spend your own money for it. Especially in the USA, debit cards may not be accepted at all when booking a rental car. Thus, you are forced to use a credit card.

The best Swiss credit card for abroad is the Migros Cumulus Visa. It offers the following advantages:

- No annual fee, including supplementary card

- No foreign currency fee

- Two free cash withdrawals per year abroad (afterwards 2.5% fee with a minimum of CHF 10 per withdrawal)

Disadvantages of Migros Cumulus

The claim “no foreign currency fee” of the Cumulus credit card is misleading. Although no additional fee is charged, the exchange rate set by Viseca is usually about 1% to 3% above the reference rate, depending on the currency. Therefore, debit cards like Radicant, Neon, Revolut, or Wise remain the best choice for intensive foreign use. Whenever a credit card is necessary, however, the Cumulus Visa is the best option.

Difference between credit card and debit card

Although both card types look similar and work worldwide at Visa or Mastercard acceptance points, there are essential differences. A credit card grants credit, with expenses settled at the end of the month. The bank grants a credit limit that allows spending money not yet actually available. In contrast, a debit card debits the amount directly from the account, limiting spending to the available balance.

In daily use, debit cards are usually accepted without problems. However, there can be restrictions with hotel reservations or rental car bookings, as a credit card is often required there. It is therefore advisable to always carry a credit card as a backup when traveling, even if you primarily use one of the cheaper debit cards presented here.

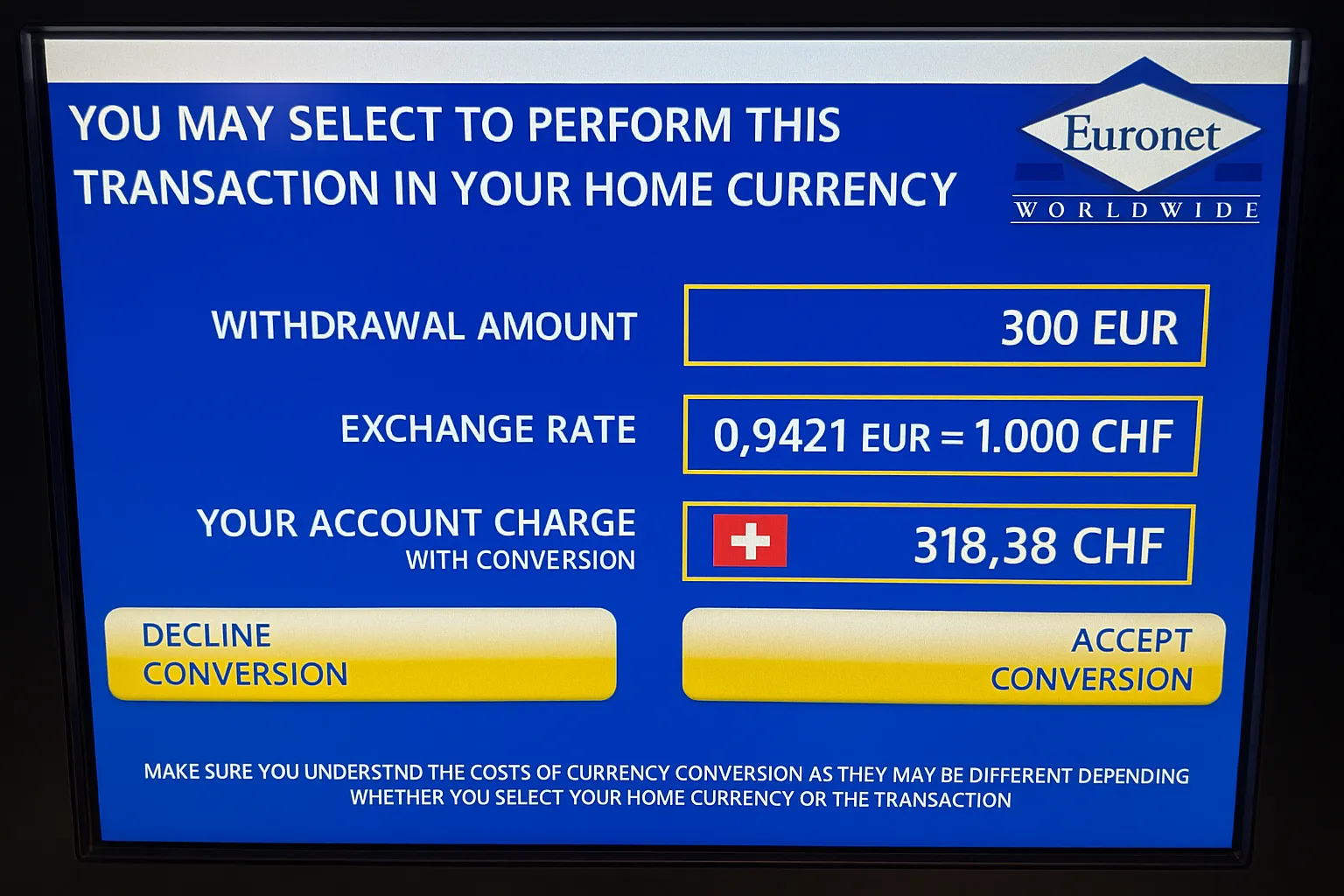

Beware at ATMs: Always decline currency conversion

When withdrawing cash abroad, many ATMs offer to convert the amount into Swiss francs for you. This is often presented as a service that supposedly offers you a “guaranteed exchange rate.” Always decline this offer and instead choose the option “without conversion” or “charge in local currency.” The exchange rate offered by the ATM usually contains a hidden markup of 5-10%, while your own card offers a significantly better rate.

The same applies to card payments in shops or restaurants, where sometimes the option to pay in Swiss francs is offered. Here too, you should always pay in the local currency and let your bank or card provider handle the conversion to get the best exchange rates.

Conclusion: The right card for abroad

The landscape of payment methods for Swiss people abroad has evolved significantly in 2025. Radicant has emerged as a new, surprisingly strong player on the market, setting new standards with 0% markup on the interbank exchange rate and only CHF 2 per cash withdrawal abroad. At the same time, established neo-banks like Neon have adjusted their fee structures. The days of completely free foreign transactions are over, but attractive options remain with the various subscription models.

The optimal card choice depends on the individual travel profile. For frequent travelers and international shoppers, Radicant currently offers the best conditions for currency exchange. Revolut and Wise continue to impress with their international orientation, monthly free allowances for cash withdrawals, and multi-currency functionality.

Regardless of the card chosen, a real credit card like the Migros Cumulus Visa is recommended as a backup. It is indispensable, especially for hotel reservations and rental cars. Also, when using ATMs abroad, always decline conversion and charge in local currency to avoid hidden markups.

With a well-thought-out combination of neo-bank and classic credit card, cost-effective and flexible use abroad is possible, avoiding unnecessary fees.