How to securely Buy and Store Crypto Currency

Bitcoin has steadily grown into a major asset class over the past few years, which leads more and more investors to become interested in it. But the landscape on how to buy and hold crypto is complicated. There are dozens of international exchanges, various fee structures, and due to the unregulated nature of crypto a higher risk of losing access to your funds through hacks, scams, or exchange bankruptcies.

Why invest in Crypto Currency?

This article is not about which cryptocurrencies to buy. That decision is up to you. I believe it can make sense to invest a small percentage of your portfolio in Bitcoin as a hedge against the traditional financial system, similar to how some investors hold gold. But I wouldn’t invest in any currency other than Bitcoin and maybe Ethereum, as everything else is highly speculative. And given the volatility, I wouldn’t allocate more than a few percent of my portfolio to crypto. So in this article we are evaluating the best ways to purchase and store crypto for long-term investment. If you do short-term crypto trading, other factors will be more important and this article is less relevant for that.

Crypto exchange fee comparison

Here’s a quick fee overview of the two crypto exchanges I recommend for Swiss investors. For a detailed breakdown of each platform, see the exchange section.

| Kraken Pro | SwissBorg | |

|---|---|---|

| Trading fee | 0.25-0.40% | 0.99% |

| CHF deposit | Free | Free |

| Custody fee | None | None |

| BTC withdrawal | ~0.00015 BTC (~CHF 10) | 0.1% + network fee |

Third-Party Storage (Custodial)

The easiest way to get started is letting a platform manage everything for you. They hold the private keys to your crypto wallet, and you just have a login to their platform. Similar to how your stocks are managed with a broker like Interactive Brokers, that holds them for you.

Pros:

- Easy to set up, no technical knowledge required

- Password reset possible if you forget login

- Customer support available

- Often integrated with trading: buy, sell, store in one place

- Some platforms offer insurance on holdings

- Convenient for active traders

Cons:

- You don’t control the private keys (“not your keys, not your coins”)

- Platform can freeze your account (compliance, legal issues, mistakes)

- Bankruptcy risk: if platform fails, you may lose funds

- Hack risk: both on the exchange level but also personal account level

- Withdrawal limits or delays possible

Custodial services are nice and easy to get started with. You sign up, deposit some money, buy crypto and that’s it! No need to deal with sensitive private keys on your own. And if you ever forget your password, customer support can help you. This isn’t a bad option if you want to get started with crypto.

But real-life cases like the collapse of FTX or the hack at Coincheck resulted in customers losing millions of crypto show that there’s risk associated. Due to the decentralized nature of crypto it’s much easier for hackers to take control of assets. Which is much less of a factor in controlled traditional banking environments with your normal stock broker. In addition to that, your personal account can also be a lucrative hacking target. Through strategies like SIM swapping or social engineering. Once the funds have been transferred out of the account, there’s nothing anyone can do to stop it. While crypto exchanges have certainly learned from all these incidents and the risk of something happening is very low, most of the crypto community still advises against keeping large amounts of crypto on exchanges. That’s where self-custody comes into play.

Self-Custody Storage

Self-custody means you’re in control of the keys to your crypto wallet. If you’re not familiar with crypto, each “account” has a public address. But you need a private, secret key to sign any transaction leaving that account. So while anyone can send money to your public address, only you in possession of the private key can send transactions out of that wallet.

Pros:

- Full control: only you can access your funds

- No counterparty risk: no exchange or bank can fail on you

- No account freezes, no withdrawal limits

- Censorship-resistant: no one can block your transactions

- No dependence on any platform

Cons:

- Lose your seed phrase = lose everything, no recovery

- No customer support: mistakes are permanent

- Learning curve for setup and security

- Physical risks: theft, fire, hardware failure

- You’re responsible for inheritance planning

- Less convenient for frequent trading

So with that you fully control your crypto and aren’t susceptible to exchange hacks or bankruptcies. But this strategy is more difficult and requires a bit of technical knowledge. You need to find a trustworthy wallet software and most importantly, securely store your key. If you lose that key there’s no way to recover your crypto.

Best crypto exchanges

No matter if you end up holding the crypto on the exchange or transferring it into self-custody, you will first have to buy them on an exchange. So let’s look at the best exchanges for Swiss crypto investors.

One general tip: even if an exchange offers debit card deposits, always use bank transfer instead as it is free with our recommended exchanges.

| Kraken Pro | SwissBorg | |

|---|---|---|

| Trading fee | 0.25% maker / 0.40% taker | 0.99% |

| CHF deposit | Free (SIC) | Free |

| Custody fee | None | None |

| BTC withdrawal | ~0.00015 BTC (~CHF 10) | 0.1% + network fee |

Kraken Pro

Kraken is one of the oldest and most reputable crypto exchanges, founded in 2011 in the United States. Kraken offers two interfaces: the regular Kraken app with a simple buy/sell feature, and Kraken Pro for more advanced trading. The difference matters for fees. The regular app charges around 1% per transaction, while Kraken Pro uses a maker/taker model starting at 0.25% maker and 0.40% taker fees. These rates apply up to USD 10,000 in monthly trading volume, which is more than enough for most investors. For most people buying and holding, you will pay the taker fee of 0.40%.

For Swiss users, Kraken supports free CHF deposits through Bank Frick in Liechtenstein. There are no custody fees for holding your crypto on the platform. If you want to withdraw Bitcoin to your own wallet, Kraken charges a dynamic fee based on current network conditions, around 0.00015 BTC (roughly CHF 10 at current prices).

SwissBorg

SwissBorg is a Swiss company founded in Lausanne in 2017. Their main selling point is simplicity. Everything happens in their mobile app, and they claim to have no hidden spreads. Instead, they charge a trading fee of 0.99% for standard accounts. This is higher than Kraken Pro, but the all-in pricing means what you see is what you pay.

For Swiss users, CHF deposits via bank transfer are free. If you want to withdraw crypto to your own wallet, SwissBorg charges 0.1% on top of the network fee. There are no custody fees. SwissBorg has some premium tiers. If you stake their BORG token, you can reduce trading fees down to 0.25%. However, this requires you to hold and lock a separate cryptocurrency, which adds complexity and risk.

Which one should you choose?

For the lowest fees, Kraken Pro is hard to beat. The 0.40% transaction fee, free CHF deposits, and reasonable Bitcoin withdrawal fees make it the most cost-effective option for Swiss investors. The interface takes some getting used to, but it’s worth learning. If you prefer a Swiss company and are willing to pay slightly more for it, SwissBorg is a solid choice.

With both platforms, you pay a small fee for transferring your crypto from the exchange to a hardware wallet. If you frequently buy small amounts that you want to move to self-custody, it makes sense to accumulate purchases on the exchange and transfer them in larger batches. This way, you spread the fixed withdrawal fee over a larger amount, reducing your overall cost percentage.

Best crypto hardware wallets

If you want to go the self-custody route, you will need a crypto wallet. A wallet is a piece of software that stores your private key and lets you sign transactions. There are software wallets that run on your computer or phone. But these are not recommended for serious crypto storage. Your computer or phone is connected to the internet and could be compromised by malware. A hardware wallet is a dedicated device that stores your private key offline. It only connects to your computer when you need to sign a transaction. This makes it much harder for attackers to steal your keys.

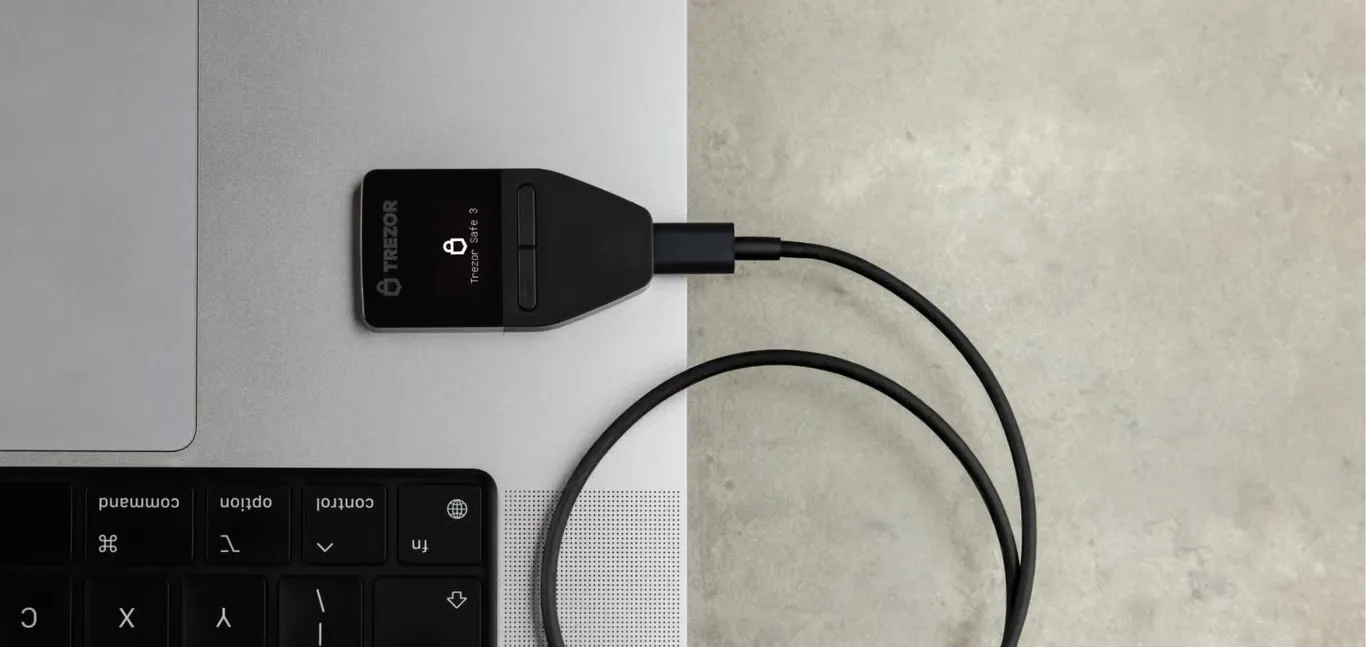

Trezor Safe 3

My recommendation is the Trezor Safe 3. It is made by a Czech company that has been in the hardware wallet business since 2013. The device costs around 50 Francs and supports a wide range of cryptocurrencies. What sets Trezor apart is that both the hardware and firmware are fully open source. This means security researchers can audit the code and verify there are no backdoors. If you only plan to hold Bitcoin, you can install a Bitcoin-only firmware. This reduces the attack surface even further by removing all code related to other cryptocurrencies.

Ledger Nano S Plus

The Ledger Nano S Plus is another popular option at a similar price point of 50 Francs. It is made by a French company and also has a long track record. The device has a good reputation and supports many cryptocurrencies. Sadly Ledger’s firmware is not open source. You have to trust that Ledger has implemented everything correctly.

Where to store the seed phrase

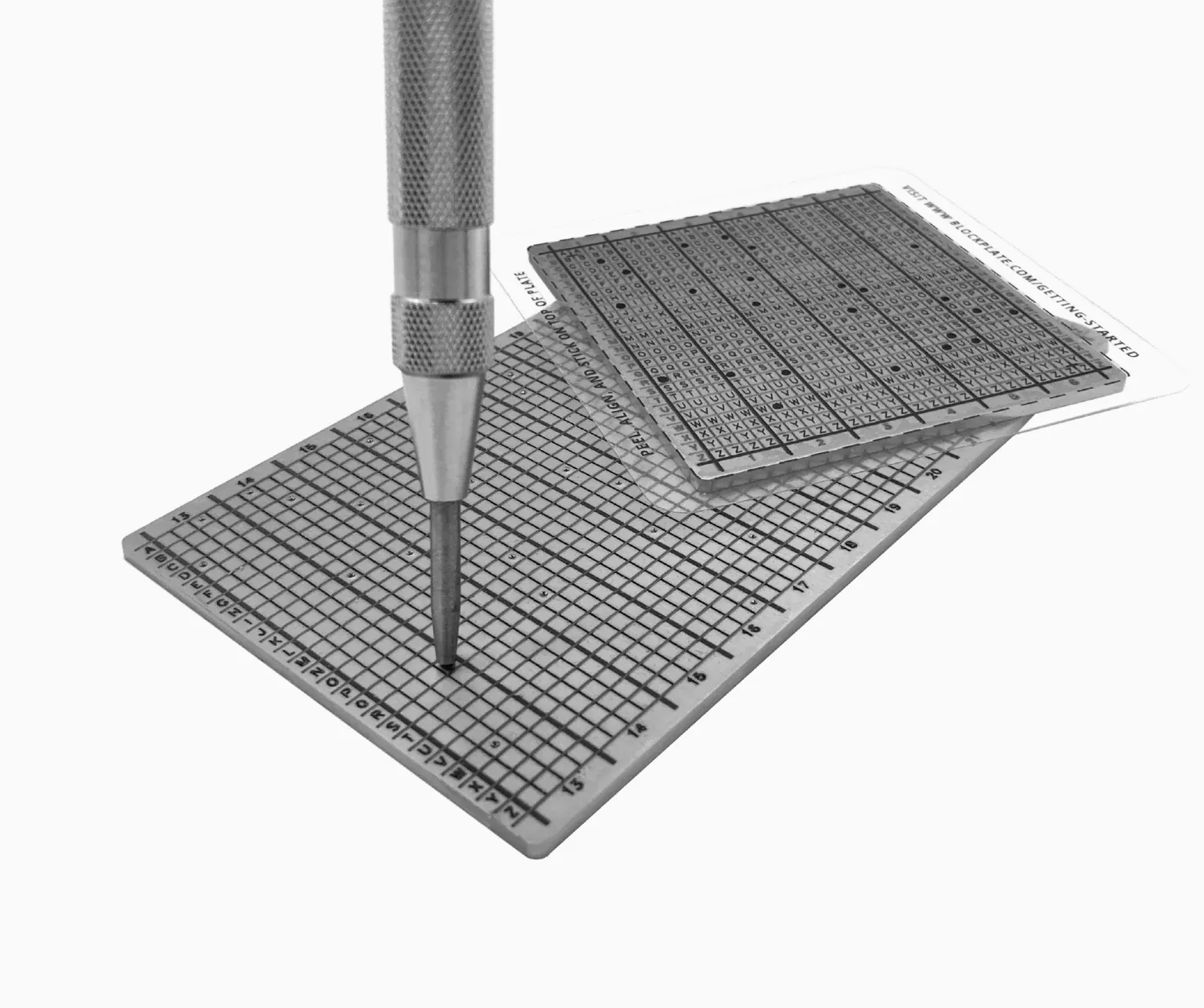

When you set up a hardware wallet, the device will generate a seed phrase. This is a sequence of 24 words that can be used to restore your wallet anywhere. If your hardware wallet breaks or gets lost, you can buy a new one and recover your crypto using this seed phrase. Which means the hardware wallet is just a way to make accessing your crypto easier and safer. But anyone that has access to your seed phrase will have full control over your crypto.

Never store your seed phrase digitally. No photos, no cloud storage, no password managers. Write it down on paper and store it in a secure location. The risk with paper is that it can be destroyed by fire or water. To mitigate this you can buy special metal plates where you stamp in the seed phrase yourself. This makes it resilient to heat, fire, and water. I recommend not storing the hardware wallet and seed phrase in the same location. If there is a fire and both the wallet and seed phrase get destroyed, you will have lost access to your crypto forever. Good methods are storing the seed phrase in a bank deposit box, in a safe at home or hidden somewhere with a trusted family member. You can also store copies in multiple locations. If you want your heirs to have access to your crypto in case you pass away, make sure they know where to find the seed phrase and have the technical know-how on how to access the crypto.

Another important fact to know is that you cannot restore the seed phrase through your hardware wallet. So if you lose your seed phrase but still have your hardware wallet, you will need to create a new wallet, write down that new seed phrase and then transfer all crypto to the new wallet. Which will result in some transfer fees.

The third option: Crypto ETF

If you already have a brokerage account and don’t want to deal with crypto exchanges or hardware wallets, a crypto ETF might be the simplest option. These funds actually hold real Bitcoin and track its price. You can buy and sell them just like any other stock or ETF through your existing broker. Which means you won’t need to buy Bitcoin through a crypto exchange and then transfer it to a wallet. You just buy the ETF directly.

The two most popular options are iShares Bitcoin Trust (IBIT) from BlackRock and Fidelity Wise Origin Bitcoin Fund (FBTC). Both have an expense ratio of 0.25% per year and can be purchased through Interactive Brokers and other normal investment brokers.

The big advantage is simplicity. No need to sign up for a crypto exchange, no private keys to manage, no seed phrases to secure. Your Bitcoin holdings show up in your regular portfolio alongside your stocks or ETFs. And unlike holding crypto on a crypto exchange, there is less of a worry about your account being hacked since you don’t hold the crypto directly.

But not holding the crypto directly can also be seen as a downside. If you treat Bitcoin as a standard investment that might not matter to you. But if part of your reason for buying crypto is to have an asset outside the traditional financial system, an ETF defeats that purpose. You’re still fully dependent on your broker and the fund manager. You also pay that 0.25% management fee every year, which adds up over a long investment horizon. If you hold for 10 years, you’ve paid about 2.5% of your investment in fees. With self-custody there is no ongoing fee at all.

So crypto ETFs are a good choice if you want simple Bitcoin exposure within your existing portfolio. But if you want true ownership and are willing to put in the effort, self-custody remains the better long-term option.

Crypto taxation in Switzerland

This is a short section, as there is not much to crypto taxation in Switzerland. It is treated like any other asset. You buy it with post-income tax money. In your tax return you declare any crypto you own based on the end-of-year value, and you will pay wealth tax on that. As a private investor, just like with stocks, if you decide to sell, you will not need to pay any tax on gains. So taxes on crypto work just like gold or stocks that do not issue dividends.

Recommendations

There is no perfect crypto strategy that applies to all investors. People have different reasons why they buy crypto. So let’s look at the most common scenarios:

If you would just like to dabble in crypto and start out with some small sums, you probably don’t want to deal with special hardware wallets. In that case using a popular exchange like Kraken or SwissBorg is not a bad choice. They make it easy to turn your Swiss Francs into crypto and will store them for you, without having to manage any private keys yourself. All you need is a login to their platform. The purchase transaction fees are fairly low and you will not pay any custody fee for storing your crypto with them. But as I have outlined, exchanges have been hacked or went bankrupt in the past. And unlike with regulated Swiss banks, there is no deposit insurance for such cases, which you should factor into your risk calculation.

Most readers of this blog will already have an investment brokerage account, such as Interactive Brokers or Swissquote. If you just want to buy Bitcoin, an ETF is a good choice. You do not need to sign up to a separate crypto exchange. And unlike regular crypto, Bitcoin ETFs are less susceptible to hacks since you just do not actually hold the underlying crypto yourself. So it is a safe and easy way to invest in crypto. However, the big downside is that you don’t actually own the crypto. If you have trust in the banking system, that won’t be a big deal to you. However if the reason you are buying crypto is to hedge against a hypothetical banking system collapse, crypto ETFs obviously aren’t for you. In addition to that, crypto ETFs have a management fee. Which will add up if you hold it over a long investment horizon.

So the third and “gold standard” option is holding your own key and accessing your crypto through a hardware wallet. With this option, you will still need to buy crypto on an exchange. But after that, instead of holding it in the exchange, you transfer it to your personal wallet where only you hold the private keys. This means you have full control over the crypto, no matter what happens to the exchange. And holding them is free, no management fee. But as a consequence, if you lose your key there is no way you can restore access to your crypto. So it is crucial to have an iron-tight backup strategy. If you have the know-how to properly do that, this self-custody is by far the most resilient way to hold crypto.