Best Third Pillar in Switzerland for 2024

In this article, I’ll explain what a third pillar, colloquially known as pillar 3a, is. Additionally, we’ll analyze which providers offer the best third pillar - both in terms of low fees and good investment returns.

What is a Pillar 3a?

As the name suggests, the third pillar is one of three parts of the state-regulated retirement provision in Switzerland. The first two pillars are generally mandatory for all employees (the 2nd pillar is optional for annual incomes of around CHF 22,000). The 1st pillar is the AHV (Old Age and Survivors Insurance) and the 2nd pillar is the pension fund. As an employee, you have little control over these.

The 3rd pillar, on the other hand, is optional and can be organized by the employee themselves. The employer has nothing to do with it. In 2024, employees can contribute a maximum of CHF 7,056 to the 3rd pillar annually. There are various providers that offer accounts for the 3rd pillar. However, there are significant differences in their structure.

What are the advantages of the 3rd pillar?

So why should one take out a 3rd pillar for their retirement provision? Wouldn’t it be better to save money in a personal account or invest in stocks? Here’s where the advantages of the 3rd pillar come into play. These can be summarized in one word: Taxes.

- Deposited amounts are exempt from income tax.

- Any interest and dividend income is also tax-free.

Depending on your income and resulting tax bracket, you can save different amounts in taxes. By contributing the maximum amount, it’s not uncommon to save between CHF 1000 to 2000 in taxes.

What are the disadvantages of the 3rd pillar?

The tax benefits of the 3rd pillar exist only because it is a retirement provision. Just like the other pillars, money cannot be withdrawn from the 3rd pillar arbitrarily. The 3rd pillar can be paid out under the following conditions:

- Financing of owner-occupied residential property

- Transition to self-employment

- Repayment of a mortgage

- Relocation abroad

- Disability or death

So, it’s important to be aware that the money deposited into the 3rd pillar is no longer liquid and can only be withdrawn under very specific conditions.

Furthermore, the balance can only be paid out in full. There are no partial payments. More on this later. A tax is levied on the payout amount. This depends on the place of residence. For example, for CHF 200,000, the tax is around CHF 10,000 - roughly 5%. However, it’s a progressive tax. For higher payouts, the tax percentage increases.

Why you should have multiple 3rd pillars

The higher the payout amount of a 3rd pillar, the higher the tax rate. A comparable example: someone earning CHF 100,000 per year for 10 years pays less tax in total than someone who earns the entire million in one year. This is progressive taxation.

With this knowledge, it’s important to spread the payout of our 3rd pillar over several years to minimize the tax burden. Unfortunately, partial withdrawals are not allowed, which is why we have to liquidate the entire account at once. This increases the tax burden and reduces flexibility.

To avoid this, it’s advisable to have multiple different pillar 3a accounts. This is easily possible. This way, you can distribute your contributions across multiple accounts. However, the annual maximum contribution must not be exceeded across all accounts. If you want to withdraw money from the 3rd pillar, you can stagger the withdrawals over several years - by liquidating only one account each year.

When a 3rd pillar doesn’t make sense

For people with low incomes, such as apprentices or students with part-time jobs, the 3rd pillar may not make sense under certain circumstances. Why is that? With a low income, one pays hardly any taxes in Switzerland. Apprentices usually pay no more than a nominal head tax. So their income tax is practically 0%.

Thus, there are no tax savings if one contributes money to a 3rd pillar. On the contrary, especially with investments, the money in the 3rd pillar can grow enormously. Especially for young people with a 40-year investment horizon. And the tax on withdrawal is not only levied on the initial amount, but also on the entire profit. Had the money been invested in a regular, free securities account, the entire profit would have been completely tax-free.

But there are other factors to consider. It’s a good habit to start retirement planning as early as possible. And contributing to the 3rd pillar creates a good habit that one can hopefully maintain. It also prevents impulse spending of saved money, as it is legally held in the 3rd pillar.

What types of pillar 3a accounts are there?

There are several types of 3rd pillar accounts. They offer different levels of risk and returns.

- Pillar 3a bank account - like a savings account, minimal returns

- Pillar 3a insurance - complex product, both investment and insurance, high fees

- Pillar 3a investments - various fund offerings, good performance, fees vary

Bank accounts as pillar 3a are hardly recommended. They are the simplest and offer the lowest risk - but they sacrifice significantly in returns. The average return on such products has been around 0.5% over the past 10 years. Especially with the long investment horizon of retirement planning, it’s difficult to benefit from the compound interest effect here.

Combined 3rd pillars with insurance are by far the worst products. I can never recommend them. At first glance, they may seem attractive. However, they come with various disadvantages. There are almost always hidden fees. And one commits for a long time, losing any flexibility.

Now, onto the last and by far the best option: Pillar 3a investments. Here, your money is invested in stocks and bonds. However, unlike a regular portfolio, you cannot completely manage your investments yourself. You have to select a specific fund in which your money will be invested.

There are both active and passive funds. Traditional banks primarily offer active funds as part of their pillar 3a products, as they are more lucrative for the bank. With active management by bankers, the fund fees are accordingly higher. The alternative is passive funds. They are not actively managed, so they have lower fees and often offer better returns. In the following sections, we will look at 3 different providers that offer cost-effective passive pillar 3a investments.

VIAC

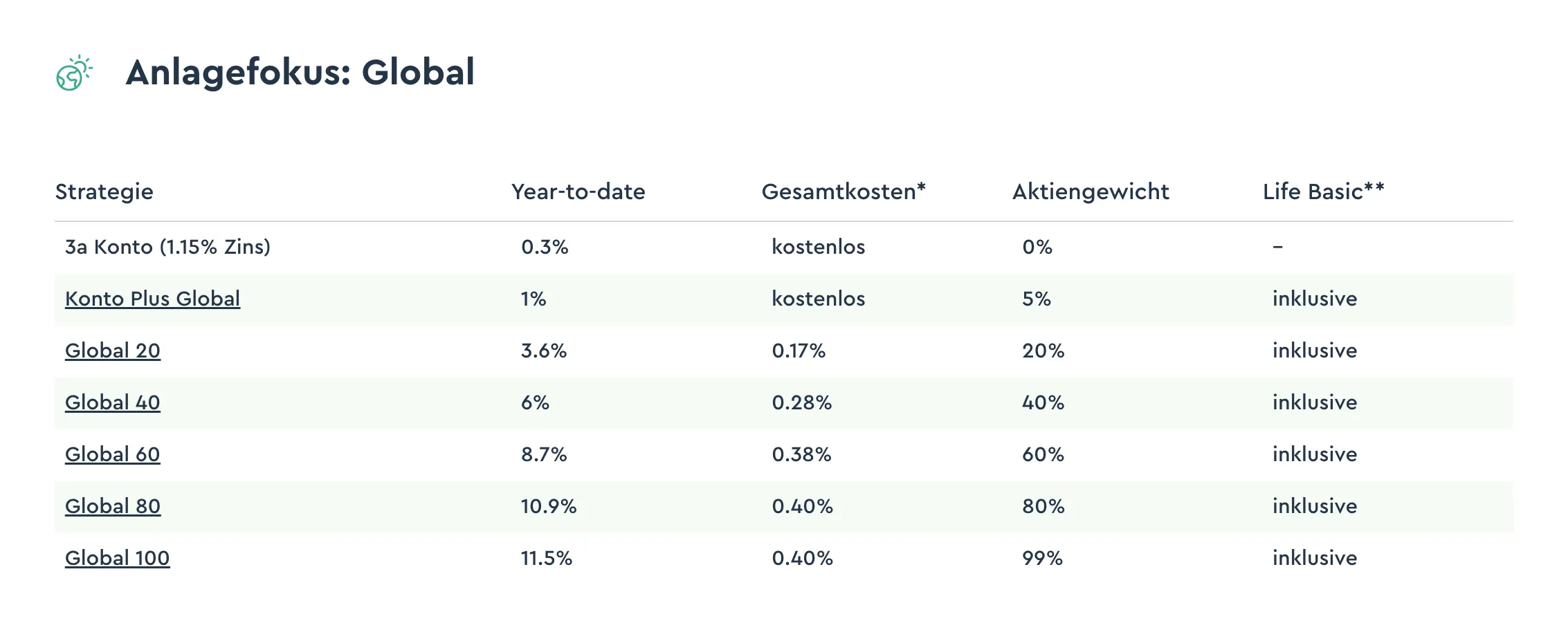

VIAC is a fully digital pillar 3a solution. It can be accessed via an app or website. You can choose between funds from Credit Suisse and Swisscanto. With Credit Suisse, the annual fees are a maximum of 0.44%, and with Swisscanto, a maximum of 0.4%. In terms of returns, the two options are almost identical.

You can choose the weighting of stocks versus bonds and cash. Up to a maximum of 99% stocks. More stocks provide higher returns in the long term, but also increase risk and volatility. Younger individuals benefit from a maximum stock weighting. Older individuals closer to a liquidation date should choose a more conservative allocation.

Three investment focuses can be selected: Global, Swiss, and Sustainable. All of them are passive funds. I would choose the global focus as having a high number of Swiss stocks in the portfolio is risky. Additionally, historical returns are higher with a global portfolio.

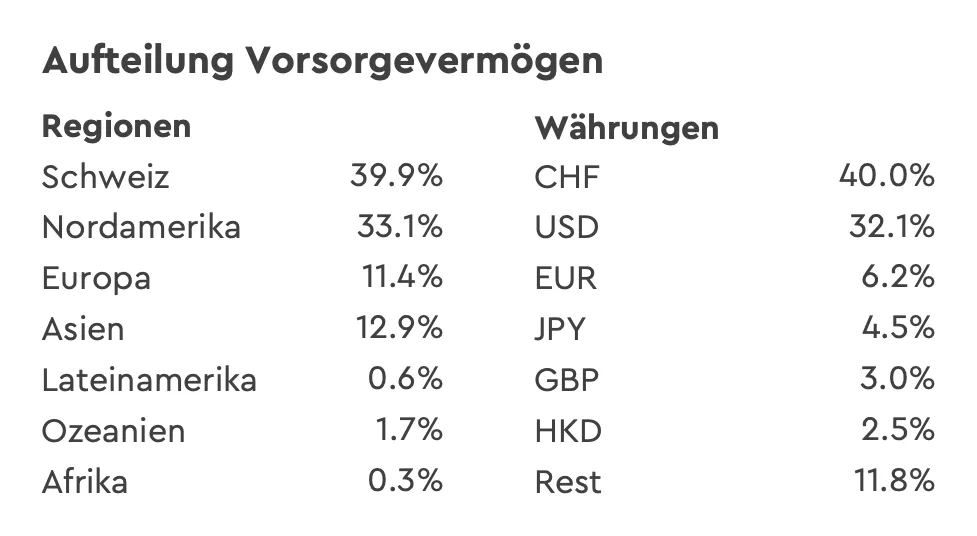

Looking at the details of the Global 100 strategy, you can see that still about 40% of the stocks are from Switzerland. If you want fewer Swiss stocks, you have the option to adjust the portfolio composition yourself.

In summary, VIAC offers a good and cost-effective pillar 3a option where you can choose from various strategies. To stagger your withdrawals, you can open up to five separate accounts with VIAC.

Finpension

Finpension is the main competitor to VIAC. It’s also not a traditional bank. Interaction is also via a modern mobile app or website. Finpension offers funds from Credit Suisse, Swisscanto, and UBS. The funds from Swisscanto and UBS are slightly cheaper than those from Credit Suisse. The fees are around 0.4%, similar to VIAC.

Just like with VIAC, you can choose the weighting of stocks versus bonds and cash. Up to a maximum of 99% stocks. More stocks provide higher returns in the long term, but also increase risk and volatility. Younger individuals benefit from a maximum stock weighting. Older individuals closer to a liquidation date should choose a more conservative allocation.

Just like with VIAC, you can choose between three investment focuses: Global, Swiss, and Sustainable. I would choose the global focus as having a high number of Swiss stocks in the portfolio is risky. Additionally, historical returns are higher with a global portfolio. Like VIAC, with Finpension, you also have the option to adjust the portfolio flexibly and choose your own funds.

To stagger your withdrawals, you can open up to five separate accounts with Finpension.

Frankly

Frankly is a product of Zürcher Kantonalbank, which competes directly with VIAC and Finpension. It’s also available as a mobile app and website. The fee at Frankly is 0.44% per year. This is slightly higher than the competition. Funds are only available from Swisscanto.

At Frankly, you can choose a maximum of 95% stock allocation. This is also lower than the competition. Additionally, there is no option to adjust the allocation individually. Thus, you are forced to have a large share of Swiss stocks. Furthermore, a large portion of the foreign currency shares in the portfolio must be hedged to Swiss francs, reducing profits.

Like VIAC and Finpension, Frankly also offers a maximum of five portfolios.

The best 3rd pillar

Now we have looked at three providers: VIAC, Finpension, and Frankly. Frankly only makes sense for those who absolutely want to use a product owned by a major Swiss bank (ZKB). For everyone else, VIAC and Finpension are better options.

There are hardly any differences between VIAC and Finpension. The fees are practically the same. You should look at both products and choose the one that suits you better. Since it’s advisable to have multiple portfolios for liquidation later anyway, you can also open one account with each.